If you currently have loans and debt for a variety of different things- education loans, credit card debt, mortgages etc., it can be intimidating to know where and how to start paying it off. The best rule of thumb is to start by paying more than the balance on all your highest interest debt (high interest credit cards and private education loans) while still paying at least the minimum required on all your other loans and debt to keep them in good status. And remember, the longer you wait to pay of your loans and debt, the more you end up having to pay!

For more information on how to prioritize paying of debt, you can check out this article from Fidelity.

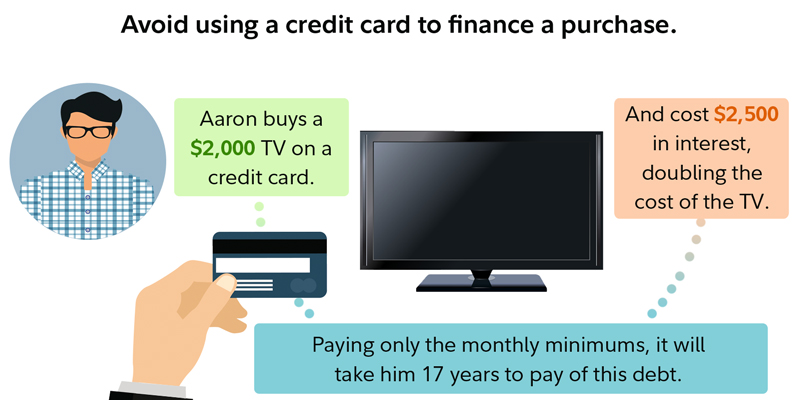

Image credit: https://www.fidelity.com/viewpoints/personal-finance/how-to-pay-off-debt